What Is the 5 Year Swap Rate Today

Money markets

All the latest money market information can be found here, including up-to-date Bank Rate, SWAP rates and LIBOR rates. We'll also have commentary and views from our in-house experts.

Rates 15th November 2021

Bank of England Bank Rate: 0.1%

UK 1 month LIBOR:0.05425% - 0.00100%

UK 3 month LIBOR:0.10175% - 0.00675%

UK 1 month SONIA:0.0489% + 0.00060%

UK 3 month SONIA:0.1594% + 0.00220%

(LIBOR figures provided by TheIce.Com, rounded to five decimal places. Effective 1st July 2014, real-time LIBOR rate information as calculated and published by ICE Benchmark Administration is liable to data charges. Licence-free display of LIBOR rates and swap rates on free access websites such as www.mortgagesforbusiness.co.uk is subject to a delay of 7 days. The latest LIBOR figures and SWAP rates are published by the ICE.)

UK SWAP Rate:

| Year(s) | Current Rate | Change from |

| 1 | 0.673% | -0.019% |

| 2 | 1.094% | -0.029% |

| 3 | 1.216% | -0.036% |

| 5 | 1.233% | -0.032% |

| 7 | 1.205% | -0.032% |

| 10 | 1.183% | -0.029% |

SWAP rates provided by TheIce.Com, rounded to three decimal places.)

Bank Rate vs 3 Month LIBOR

The following graph, updated monthly, indicates how the 3 Month LIBOR has compared to Bank Rate over the past 12 months.

What is Bank Rate?

What is Bank Rate?

Bank Rate is the interest rate at which the Bank of England is prepared to lend short-term money to financial institutions. Also referred to as Bank Base Rate, it directly affects short and longer-term interest rates set by commercial banks, building societies and other institutions for their savers and borrowers.

Bank Rate is set each month by the Bank of England's Monetary Policy Committee and the monthly decision is announced at noon immediately following the meeting. Decisions are made on a one-person-one-vote basis, with the Governor having the casting vote if there is no majority.

By changing the rate of interest, the MPC is attempting to influence the overall level of activity in the UK economy and keep a healthy balance between supply and demand.

Reductions in Bank Rate usually occur when the demand for goods and services falls to such a level that unemployment rises and businesses start to close. Increases in Bank Rate usually occur when the demand for goods and services rises at a faster pace than can be supplied by the economy.

Bank Rate had been held at 0.5% from March 2009 until August 2016 when it was reduced to 0.25%. In November 2017, the MPC voted to raise it back up to 0.5% and it continued to climb in August 2018, where it was raised to 0.75%. In March 2020, the UK saw the COVID-19 virus spread across the world and within the UK. As a result of the efforts to contain the virus, the UK was placed into lockdown. Due to the economic impact of locking down the UK, and in an effort to support the economy over this difficult period, the Bank Rate was slashed to 0.25% on the 11th March 2020, and further to just 0.1% just a week later, on the 19th March.

What is LIBOR?

LIBOR stands for London InterBank Offered Rate and is the rate of interest that banks charge to lend money to each other. Each bank operating in the London market reports its own LIBOR for its cost of borrowing on the London market, and the rates reported by the larger banks are correlated by Ice Benchmark Administration (IBA)* daily to determine an overall market rate for LIBOR.

The wholesale markets allow banks that need money to be more fluid in the marketplace to borrow from those with surplus amounts. The banks with surplus amounts of money are keen to lend so that they can generate interest on the loans which they would not otherwise receive.

Historically LIBOR has run at between 0.15% and 0.25% in advance of where the markets believe Bank Rate will be in 3 months' time. This premium has fluctuated considerably in the period since the financial crash in 2008, before hovering around 0.6% for a while. Due to the COVID-19 pandemic, the LIBOR rate has similarly declined to around 0.2%.

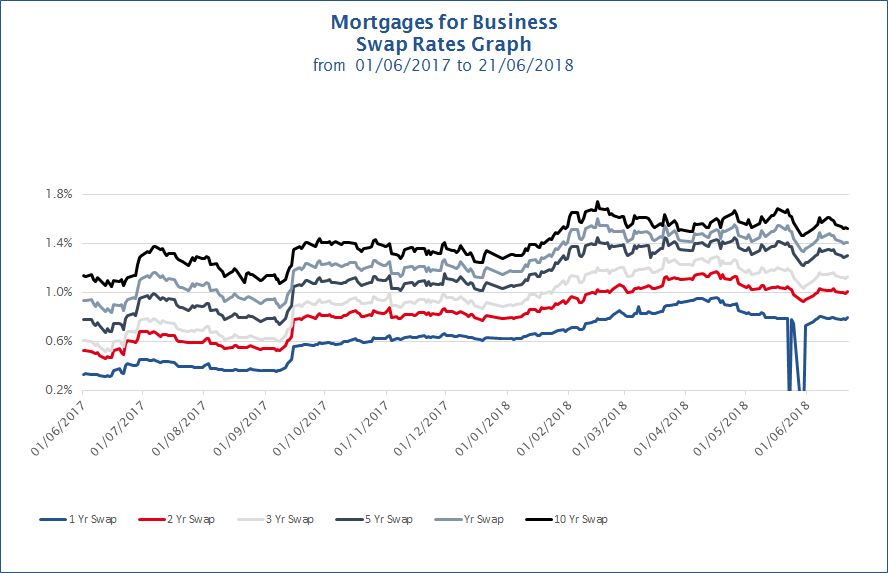

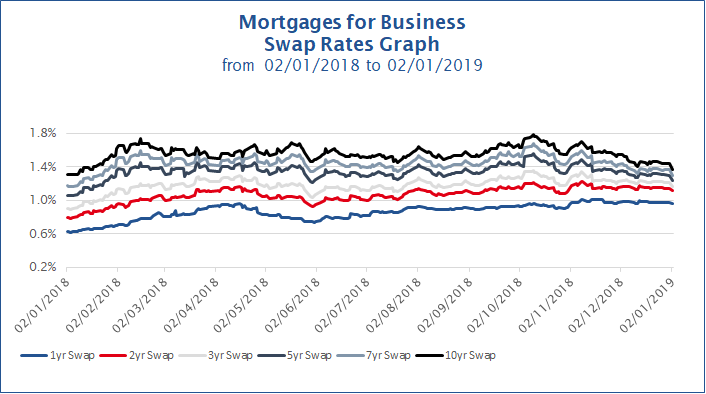

Historic SWAP Rates

The following graph, updated monthly, indicates how the Swap rates have moved over the past 12 months.

What are SWAP Rates?

SWAP rates are a mechanism through which lenders can acquire a fixed price for funding over a specific period of time, normally from 1 year to 10 years – although most commonly 2, 3, 5 and 10 year SWAP rate programmes are used as these are then used to create fixed rate mortgage products for homeowners, property investors and business mortgages.

SWAP rates will factor in what the money markets see as the likely average rate over the chosen time period and can sometimes be cheaper than the prevailing variable rate and therefore result in a product (by the time the lender has added a margin) that is not only attractive but also provides the borrower with certainty of mortgage costs over the chosen period.

Some lenders will have sophisticated SWAP rate money management programmes and will be in a position to run a rolling fixed-rate programme – i.e. offering a fix from the day of completion whereas some will work to a fixed end date such as fixed to 31 Aug 2014 which is more transparent to monitor.

As with any market, traders will occasionally "make the wrong call" and fixed rates based on unknown future events can look dramatically attractive – simply the price appears "too good to be true". If this happens, we recommend you check out the fees and any early redemption charges (ERCs) and if it still works, grab it before it goes.

*On 1st February 2014, Ice Benchmark Administration (IBA) assumed responsibility as the new administrator for LIBOR from the British Banker's Association (BBA). ICE works with a small group of large banks to set LIBOR on a daily basis.

What Is the 5 Year Swap Rate Today

Source: https://www.mortgagesforbusiness.co.uk/research-data/money-markets/